(Updated 28 March 2025 refer to our announcements page for subsequent updates)

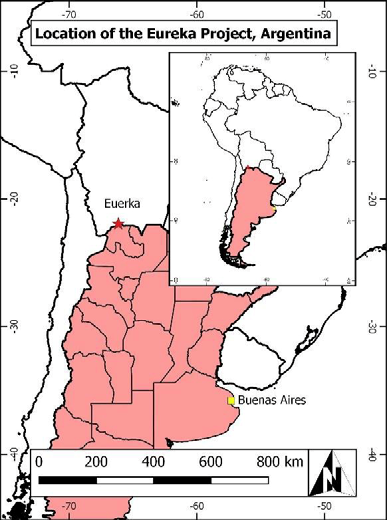

Argentina is the second largest country in South America, constituted as a federation of 23 provinces and an autonomous City, Buenos Aires. It is the eighth largest country in the world by land area and the largest amongst Spanish-speaking nations, although Mexico, Colombia and Spain are more populous. Argentina is one of South America’s largest economies, with a similar high quality of life and GDP per Capita. The country has a firm foundation for future growth for its market size, the levels of foreign direct investment and percentage of high-tech exports, as a share of total manufactured goods. Argentina is a founding member of the United Nations, Mercosur and the Union of South American Nations, along with being one of the G20's major economies.

On 25 February 2025 the company announced that the Company has agreed head of terms (the “HoT”) with Ajax Resources Plc (“Ajax”) (LSE:AJAX) to sell Puna Metals S.A. (“Puna”) which holds mining rights for a total of 12 mining licences comprising the Eureka Project located in the Republic of Argentina (“Eureka” or the “Project”).

Under the HoT, Bezant proposes, subject to the parties entering into a share purchase agreement, to sell 100% of Puna by way of an initial US$120,000 cash payment, with deferred consideration of an additional US$100,000, to be satisfied through the issue of new ordinary shares of 1 pence each in Ajax to Bezant (the “Disposal”).

The deferred consideration element of the Disposal will become payable on the admission to trading of the enlarged share capital of Ajax to a recognised stock exchange or multilateral trading facility, with the value of the deferred consideration calculated by reference to a broader fundraising concurrently undertaken by Ajax.

Bezant’s audited accounts to 31 December 2023 included total assets of £11K and liabilities of £105K in relation to the Eureka Project.

Eureka Project

The Eureka Property covers in excess of 10 thousand hectares and is located in the north-west corner of the Jujuy province in northern Argentina, adjacent to the border with Bolivia and at an altitude range of approximately 3,600 to 4,400 metres (above sea level). There is excellent road access to the Property from the provincial capital of San Salvador de Jujuy approximately five hours drive to the south, as well as easy access within the Property via a series of good quality gravel roads.

The tenements are situated within the Argentinean portion of the regionally extensive Bolivian-Argentinean Tertiary Belt (Puna-Altiplano high-plateau) and there are essentially two major metallogenic associations present. The Ordovician basement is often mineralised with gold-bearing quartz veins and, when eroded, can develop placer deposits in alluvial settings. The Miocene fluvial auriferous conglomerates also show an extensive copper mineralisation, probably related to hydrothermal waters during the Miocene volcanism. These types of mineralisations are known to host Red Bed copper deposits, being of a type similar to that of the most famous Corocoro copper deposit in southwest Bolivia (Chapman 2007). The property hosts an historical mine known as the “Eureka Mine”, which had been exploited by the Jesuits since the 17th century, with an artificial dam having been constructed for washing the gold extracted from the Mine. Further industrial-style exploitation of the gold started in circa 1885 (Novarese 1893), along with further exploitation in the “La Perdida” (now called “El Torno”) and the “San Francisco” Mines. The most recent copper extraction began circa 1949 and then continued in sporadic form to 1975 (Coira et al 2002). The latest exploration activities in the area (1980 – 2001), were carried out by Mantos Blancos, Paramount Ventures and Finances and then also more recently, by Minera Penoles and Codelco. The Company has a specific interest in 11 exploration licences covering tenements within the Eureka Property.

To date, previous exploration has indicated a noncompliant resource estimate from Penoles in the order of 62 million tonnes grading at approximately 1% for copper (62,000 tonnes of copper) and from Mantos Blancos, an estimate of 600,000 tonnes grading at approximately 2.7 g/t of gold (52,000 ounces of gold).

In January 2012, the Company renegotiated an accelerated acquisition of 100 per cent. of the Eureka project, achieving a saving of US$1.3 million versus the original staggered acquisition price. Accordingly, the Company is now the sole owner and operator and has total discretion over all exploration expenditure on the project. The Company has previously announced that it has completed Phase I of its initial exploration programme in relation to the evaluation of historical data and the generation of a geographic information system (GIS) database. This included the identification of encouraging geophysical responses with zones of high electrical chargeability and resistivity, which shall provide additional targets for the Company’s planned ongoing exploration programme.

Argentina’s COVID situation in 2020 and 2021 discouraged prospective investors from visiting Argentina but now that Foreign Nationals are permitted to visit Argentina the Company intends to focus on securing a joint venture partner and or conducting exploration on the Eureka project.

MANKAYAN COPPER-GOLD PORPHYRY DEPOSIT

(Updated 28 March 2025 refer to our announcements page for subsequent updates)

Introduction

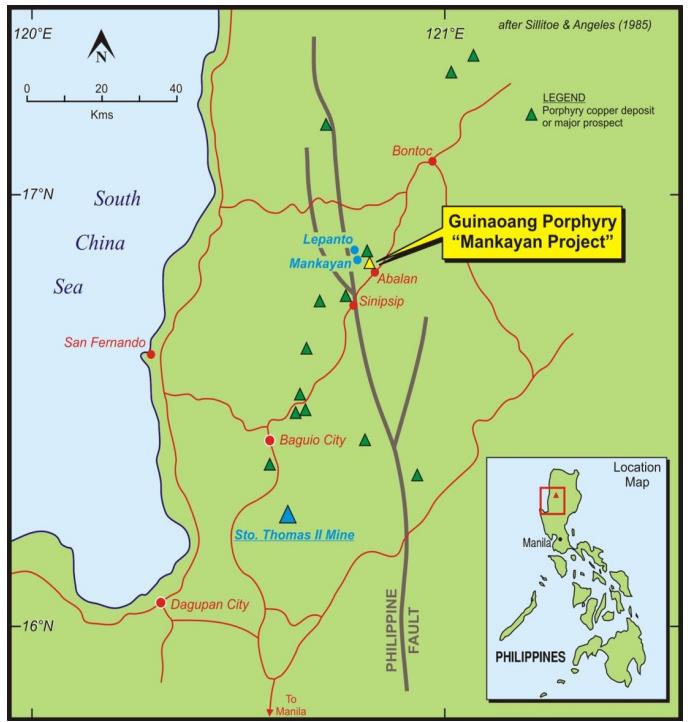

Situated in the heart of the prospective Mankayan Mineral District in Northern Luzon, Philippines, the Mankayan copper-gold project is regarded as one of the largest undeveloped copper-gold porphyry mining projects in the world. The project holds a 25-year mining licence (MPSA) and is strategically positioned near major operating mines, including the Lepanto epithermal deposit and Gold Fields Far Southeast porphyry deposit.

Bezant Resources holds an indirect stake in the Mankayan copper-gold porphyry project through its 22.96% shareholding in IDM International Limited (idminternational.com.au), who are the operator of the project. On 6 February 2025, IDM announced a proposed merger agreement with ASX-listed Blackstone Minerals LTD. Under the terms of the merger, shareholders will receive 7.4 Blackstone shares for every 1 IDM share that they own.

On 5 February 2025, Bezant converted its AUD137,500 IDM Convertible Loan Note (plus accrued interest) and received 752,143 IDM shares and 343,750 options to acquire IDM shares at AUD0.40, expiring on 5 February 2029 (“IDM Loan Note Conversion”).

Prior to the IDM Loan Note Conversion, Bezant owned 19,381,054 IDM shares, recognized in its 2023 accounts at AUD 0.20 per share, equal to £2,072,000. The AUD137,500 IDM Convertible Loan Note was recognized in Bezant’s 2023 accounts at £78,000.

If the merger is completed, Bezant will receive 148,985,657 Blackstone shares and 2,543,750 options to acquire Blackstone shares at AUD0.06, expiring on 5 February 2029, for its IDM shares and IDM options.

The Blackstone merger is expected to provide the catalyst required to advance Mankayan forward towards the operational stage.

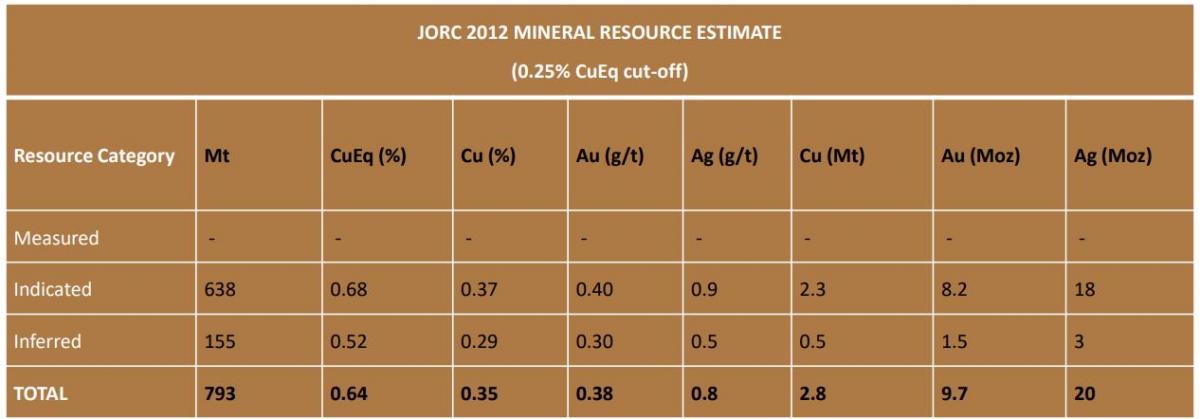

The combined JORC (2012) compliant Indicated and Inferred mineral resource estimate for the project stands at an impressive 793 million tonnes of ore grading at 0.64% CuEq, for a total of 2.8Mt of contained copper, 9.7Moz of contained gold, and 20Moz of contained silver, at a 0.25% CuEq cut-off.

Over 56,800m of diamond drilling has been completed on the resource, and detailed mining studies project the deposit to be beneficially exploited via underground shaft and block-caving methods. IDM International is currently completing advanced scoping, prefeasibility, geotechnical, and metallurgical studies on the project.

The Philippines boasts a rich mining history and is known to be the 5th most mineralized country in the world, with a supportive jurisdiction that highlights mining as an economic priority.

Figure 1. Location of the Mankayan Copper-Gold Project in the Luzon Province of the Philippines (Source: IDM International)

Tenure

The Mankayan Project covers is held under Mineral Production Sharing Agreement MPSA 057-96-CAR, totalling 458ha, and was renewed to Crescent Mining Development Corporation (a subsidiary of IDM) for a second 25-year term with effect from 12 November 2021. A Mineral Production Sharing Agreement (MPSA) is a mining right which grants the contractor (in this case Crescent) the right to conduct mining operations within a contract area.

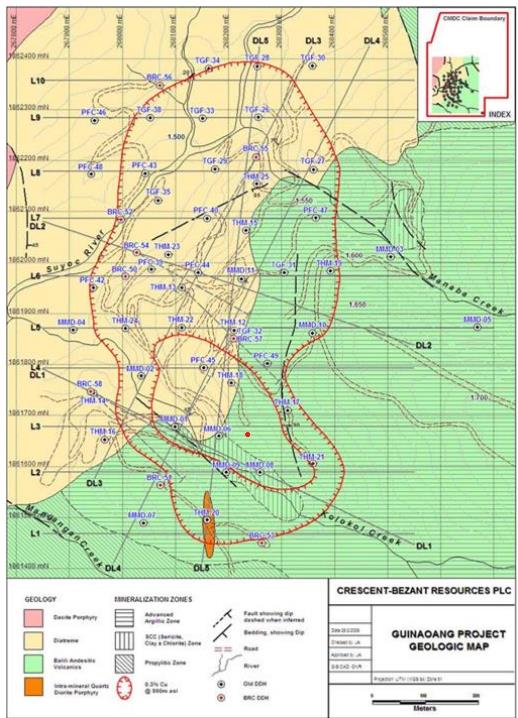

Background Geology

The copper mineralisation encountered at Mankayan is emplaced along the southeastern extension of the Lepanto fault, which is also host to the Far Southeast and the Lepanto deposits. The deposit is typical of porphyry copper-gold deposits in the region and is characterised by two distinct phases of igneous intrusion. Both intrusive complexes host copper and gold mineralisation and are largely composed of quartz diorite porphyry rocks, detailed as;

- A primary hornblende quartz diorite porphyry (QDP), described locally as the sun-mineral quartz diorite porphyry

- A later quartz diorite porphyry (IDQ), that has intruded the QDP body in the southern part of the project area, described as the intra-mineral quartz diorite porphyry

The most important host for the copper mineralisation is the QDP, with the IQD containing lower grade mineralisation. The immediate volcanic host rocks surrounding the plutonic rocks are also mineralised in proximity to the diorites.

The Mankayan intrusive complex occupies an area that broadly strikes north-south, and is of sub-vertical orientation. The porphyry is roughly 900m long and 400m wide in plan section, and surface outcrop is limited. The plutonic bodies are located roughly 200m to 400m below the surface, and extending to a depth of around 1,100m deep, where the deposit remains broadly open.

Figure 2. Project geology of the Mankayan deposit

Figure 3: High-grade Gold-Copper Ore from Mankayan porphyry (Source: IDM International)

Figure 4. East-west cross section at 1861990 mN (Source: Derisk, 2020 – Mineral Resource Estimate for the Mankayan Project)

JORC (2012) COMPLIANT MINERAL RESOURCE

Mankayan is estimated to have combined Mineral Resources of 793 million tonnes containing 2.8Mt of copper, 9.7Moz of gold and 21Moz of silver. It has an Indicated Mineral Resource of 638Mt @ 0.37% Cu, 0.40g/t Au and 0.90g/t Ag, and an Inferred Mineral Resource of 155Mt @ 0.29% Cu, 0.30g/t Au and 0.5g/t Ag.

Further potential remains to extend the resource through additional drilling, as well as delineating higher grade copper-gold zones within the deposit as a potential focus for mining start-up.

Table 1: JORC (2012) Combined Indicated and Inferred Mineral Resource for the Mankayan Resource (Source: IDM International)