Namibia

Namibia

HOPE COPPER-GOLD PROJECT

(Updated 30 October 2025 refer to our announcements page for subsequent updates)

Highlights

HIGHLIGHTS OF SOUND MINING FEASIBILITY REPORT SUMMARY

- Proposed use of NLZM Plant: The Run of Mine (“RoM”) ore mined at the Project mine site will be pre-concentrated on-site using multi-sensor dry ore sorting technology before being trucked to the NLZM Processing Plant for concentration and production of a final product for sale. The NLZM Processing Plant is approximately 190Km from the Project mine site.

- Epoch Resources (Pty) Ltd (“Epoch”), a qualified tailings deposition engineering company based in South Africa, was engaged by the NLZM Processing Plant operator to design a Tailings Storage Facility (“TSF”) with a total capacity of 1,520,000 tonnes at an average deposition rate of 217ktpa. The new TSF was constructed according to the Epoch TSF design with an estimated total of 100kt having been deposited in the TSF prior to the NLZM mine and plant going under care and maintenance. This results in a remaining designed and permitted capacity 1,420,000 tonnes with deposition rates of up to 217ktpa achievable. The Hope and Gorob project has an estimated annual deposition rate of 160ktpa (180ktpa plant feed less concentrate extracted) which is well below design deposition rates of 217ktpa and amounts to a remaining life of facility of 9 years before an expansion to the TSF is required.

- Technical Report on NLZM Processing Plant: Section 10 of the Report is an independent technical report on the NLZM Processing Plant and describes how the NLZM Processing Plant will be used to process a copper-gold preconcentrate produced at the Hope and Gorob mine site using multi-sensor dry ore sorting.

- As detailed in Section 10 MetalX provided a site review report detailing findings and recommendations following a site audit of the NLZM Processing Plant, commissioned by Bezant Resources. The audit assessed the NLZM Processing Plant’s readiness to transition from lead-zinc processing to a dual copper oxide and sulphide flotation system, in preparation for preconcentrate from the Hope and Gorob mine. Key recommendations include upgrading flotation circuits, improving milling and dewatering systems, and implementing modern automated controls. Flexibility to revert to lead-zinc processing was also advised. MetalX proposed a two-phase plan for the NLZM beneficiation plant upgrade, starting with detailed engineering to refine costs and schedules, followed by execution involving procurement, construction and commissioning – all aligned with Bezant Resources’ strategic goals.

- Financial Summary: The financial model summarised in Section 11 of the Report was conducted and signed off by ENC Minerals (Proprietary) Limited, with cost contributions from the relevant subcontractors involved in the Project. The model was developed using the mine plan and schedule provided by Sound, covering the Hope, Vendome and Gorob areas. The RoM mine plan and schedule was adjusted by a factor of 0.8 to allow for the inclusion of Inferred Mineral Resources in the mine plan and any unforeseen factors impacting on production outputs.

- To ensure the pit design and scheduling accurately reflected current cost assumptions, the mining input costs were sourced from a cost proposal by the preferred mining contractor, Unitrans Namibia (Pty) Ltd. This ensured alignment between operational planning and financial modelling, resulting in a more robust and realistic project evaluation. The financial model incorporates RoM material upgraded via ore sorting to produce a preconcentrate to reduce transport costs to the NLZM concentrator, located approximately 190km from the mining site at the Project. It assumes that 25% of RoM fines are sent directly to the concentrator, while the remaining material is processed through a multi-sensor ore sorter. The input parameters used in the financial model are shown in Table 1 (below) and the Financial Outcome from the financial model are shown in. Table 2 (below) and include an IRR of 62%, NPV of USD46.2M and net profit of USD104M.

- Contents and consultants and contributors to the Report: The Report includes an executive summary and introduction and sections on geology, drilling, mineral resource estimate, mining, legal and environmental, laboratory services, metallurgy and mineral processing, engineering, NLZM Processing Plant, Financials, Sound Mining capability statement, references (including glossary and abbreviations) and report compilation statement. Table 1 in the Report is a summary of the consultants and companies that contributed to the work referenced in the Report.

- Conclusion: The acquisition of the NLZM Processing Plant significantly enhances the overall profitability of the Hope and Gorob Project. By eliminating the need for a new plant construction, both capital expenditure and project lead time are substantially reduced. Additionally, the use of an existing, permitted facility minimises the time and complexity associated with regulatory approvals, offering a streamlined path to production compared to developing a greenfield processing site. The financial model presents a strong economic case for the Project, justifying the decision to advance to the execution phase.

- Availability of Report: Extracts of the report will be included in the general meeting circular that Bezant Resources is preparing in connection with obtaining shareholder approval for the acquisition of a 90% shareholding in Namib Lead and Zinc Mining (Proprietary) Limited (“NLZM”) which owns the NLZM Processing Plant.

AWARD OF MINING LICENCE

On 16 October 2024 Bezant announced that it had received the notice of preparedness for the granting of Mining Licence 246, subject to standard terms and conditions including the granting of an Environmental Clearance Certificate. This Mining Licence covers the area where the Hope, Gorob, Vendome, Anomaly, Du Preez and Luigi deposits are located. Exploration licences 5796, 6605 and 7170 were also extended by the Ministry of Mines and Energy in 2024.

On 25 June 2025 Bezant announced, further to its announcements in April 2025 regarding the award of an Environmental Clearance Certificate (“ECC”) for the Hope and Gorob Mining Project ML 246 on EPL 5796, that the Ministry of Mines and Energy had issued the formal mining certificate for Mining Licence ML 246 which is valid until 31 March 2040 to Hope and Gorob Mining (Pty) Ltd which is 70% owned by Bezant.

The project currently has 11-years mine life potential detailed across the known resources at Hope, Gorob and Vendome, totalling 4.3Mt of RoM, at an average copper grade of 1.42%. The Anomaly, Du Preez, Luigi deposits, as well as the underground potential for both Gorob and Vendome are yet to be assessed in a detailed mining study, which could add additional tonnage to the operation. Further upside exists to extend the project via possible lateral extensions of these known deposits and any other discoveries made over several broadly defined targets on EPLs 5796, 6605 and 7170.

proposed acqusition of Nlzm processing plant

On 13 August 2025 Bezant announced it had entered into a conditional share purchase agreement to acquire a 90% shareholding in Namib Lead and Zinc Mining (Proprietary) Limited (“NLZM”) from CL US Minerals LLC (“Vendor”) (“Share Purchase Agreement” or “Agreement”). NLZM owns an ore processing plant (“NLZM Processing Plant”) which once modified it is proposed to use to process copper-gold run of mine (“RoM”) ore from Hope and Gorob which has been pre-concentrated on-site using dry ore sorting technology.

Highlights

- The acquisition of the NLZM Processing Plant removes the longest lead item in the Hope and Gorob mine plan, and accelerates production by at least 2 years, whilst eliminating of the significant capital cost required to build a processing plant of this type.

- The structure of the Agreement is a USD2.5m payment on completion together with royalty payments based on processing plant throughput and copper and other ore sales.

- The acquisition of NLZM Processing Plant provides Bezant with a multi-purpose facility, which can be utilised to treat the copper and gold ore from the Hope and Gorob mine and also at a future date the zinc – lead – silver ore identified in the associated underground mine owned by NLZM.

- RoM material from the Hope and Gorob mine will be processed at the mine site using dry ore sorting technology to be established at the mine site and which has been the subject of pilot testing. This pre-concentration step is designed to reject marginal or low-grade ore, thereby upgrading the feed and significantly reducing the tonnage hauled and associated cost to the NLZM Processing Plant.

- Considerable exploration potential exists between Hope and Gorob and its various strike extensions over more than 97 strike kilometres and upon commencement of the operation confirmatory resource drilling will commence with a target in excess of 500,000 tonnes of contained copper.

- The NLZM recommencement will result in job creation in the Swakopmund area with a pool of experienced previous plant operators immediately available.

- As part of the process of obtaining shareholder approval to the Share Purchase Agreement the Company will be providing a technical report which will include a third party independent Financial Model which takes into account the acquisition costs of NLZM and the future royalty payments to the Vendor and at a discount rate of 10%, yields a Net Present Value (NPV) of USD46.8 M and an Internal Rate of Return (IRR) of 63%, indicating strong financial viability and investor appeal.

PROJECT INTRODUCTION

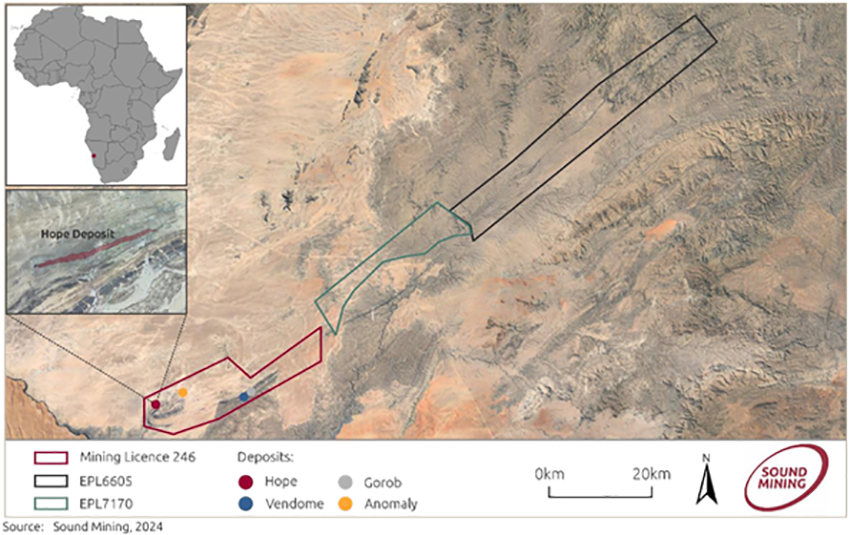

The Hope Copper-Gold project spans approximately 800km2 within the prospective Matchless Copper Belt in central Namibia. The project comprises Mining Licence 246 (M246) which is active over the Hope, Gorob, Vendome and Anomaly deposits, which the company is exploring for near-term, open-pit mining potential, plus adjacent tenures EPL 5796 (243 km2), EPL6605 (419 km2) and EPL7170 (140 km2).

The licences are located approximately 100km to the southwest of Windhoek, the capital of Namibia, and about 120km to the southeast of the major African port of Walvis Bay.

Figure 1. Location of the Hope & Gorob mining licence and tenures

The Matchless Copper Belt is situated in the Namib Desert, within the Swakopmund District of the Erongo Region, and is easily accessible via well-maintained gravel roads. This belt contains multiple high-grade copper-gold Besshi-Type volcanogenic massive sulphide (VMS) deposits, including the historically mined Otjihase Copper-Gold deposit (>16Mt @ 2.2% Cu & 1.2g/t Au), that is located northeast of the Hope property.

In 2022, the Company conducted shallow resource upgrade drilling across the known resources in the property. This work facilitated an updated Mineral Resource Estimate (MRE) for licence ML246, which was released in 2023.

Total JORC (2012) compliant, indicated and inferred resources, reported in the 2023 MRE across all four main deposits (Hope, Gorob, Vendome and Anomaly), are estimated to contain 15Mt gross at 1.2% Cu, totalling 190 thousand tonnes of contained copper. The Hope Deposit alone accounts for 4.2Mt at a copper grade of 1.7%, representing approximately 28% of the total tonnage and 37% of the contained copper in the MRE.

A detailed mine scoping and optimisation study completed in 2024, identified the potential for a 5-year open pit operation, followed by a 4-year underground phase at the Hope deposit.. Production rates are projected at 480ktpa for the open pit resource, and 220ktpa for the underground resource, with feed grades of 1.25% Cu / 0.25 g/t Au, and 2.04% Cu / 0.48 g/t Au, respectively. Additionally, the Gorob and Vendome deposits could extend mine life by an extra two years at a production rate of 480ktpa and a copper grade of 1.28%.

Further resource upgrades are possible by incorporating unrealised gold potential into the MRE, particularly at Gorob and Vendome, where historical drill-core was not routinely sampled for gold. In addition, a number of other targets including Anomaly, Anomaly A, Luigi and Du Preez that have either surface evidence of mineralisation or wide-spaced borehole data offer scope for additional open pittable mineralisation subject to further drilling and resource estimation.

Mine design and production schedules have been completed for the open pit portion of the Hope Resource and more recently, geotechnical test work and highly successful ore sorter optimisation and modulation tests have been completed. Previous ore processing test work indicated excellent recoveries of copper and gold in concentrate via conventional flotation. The ability to produce a high-grade pre-concentrate using a dry ore sorting process ahead of final concentration via flotation provides the means of generating a final product at the requisite grade for sale.

MINE PLANNING

MINE PLANNING

Mine planning is ongoing so please refer to the Company’s announcements regarding this. The following is a high level summary of the detailed work being undertaken by the company and external consultants in relation to the establishment of a mine at the Hope and Gorob project subsequent to the Company’s announcement on 9 August 2022 that the Company had submitted a mining licence application

Ore Sorter Optimisation – see 12 February 2025 announcement

Sound Mining International Ltd independent technical report on the near term development of the hope deposit where mining and processing are expected to commence (Report) – see 15 November 2024 announcement

Highlights of the Report

Notes:

*The grade and tonnage figures used in the Report are based on the Hope & Gorob Updated Mineral Resource Estimate which includes Indicated and Inferred Resources – refer to RNS dated 27 October 2023. **Project-specific risks are outlined in the Report.

Whilst the mining licence was pending, the Company as announced on 13 June 2022 had progressed all other technical aspects of the Project including the finalisation of infrastructure, mine and pre-concentrator final designs, audit and costing for the repurposing of an existing flotation plant located within trucking distance of Hope & Gorob to process pre-concentrate from the new mine and the adoption of a renewable energy solution building on existing environmental initiatives included in plant design. Other environmental initiatives include, amongst others, minimising water consumption on site through the use of dry ore sorting as a pre-concentration step.

Highlights

Summary of ongoing work from the Company’s 2023 accounts

Ore sorting test work has been completed using a test plant located at Uis, Namibia. The ore sorting specialist, has completed test work concluding that “there is a very high probability that ore sorting can successfully be employed as a pre-concentration step on the coarse Run of Mine fractions (>10mm)”.

Magnetic separation test work on <10mm fines generated during ore sorting has also been independently assessed. The material was found to be amenable to magnetic separation and, depending on magroll settings a Cu upgrade ratio of between 1.5-2.0 times could be achieved in the non-magnetic fraction. Product Cu grades ranged between 3.6-5.2% at Cu recoveries of up to 75-80%. This indicated that a high-grade fines fraction can be produced for initial processing with a low-grade rejects stream stockpiled for potential future processing.

Characterisation flotation test work has also been carried out which concluded, using a two-stage flotation circuit (Rougher – Cleaner) an upgrade ratio of 6 times can be achieved producing a final concentrate of 28 – 30% Cu (+ Au). No elevated levels of deleterious elements could be detected in the final concentrate product.

Renewable power supply options are being considered ahead of selection of a contractor for the implementation of an IPP contract to supply power to the Hope & Gorob mine site and supporting infrastructure.

Community development initiatives have been advanced with highly positive discussions with the Topnaar community, the nearest residents to the Hope & Gorob Project, located approximately 40km from the mine site. Facilitated by the Office of the Regional Governor, Bezant has received positive feedback from the Community and the Company has instructed its external Namibian environmental consultant to discuss proposed community-based projects in more detail.

Engineering design & costing work has enabled the Company to move from a conceptual design to a generally agreed flow sheet and development strategy for the operation.

Negotiations are continuing with specific reference to acquisition of existing infrastructure expected to significantly reduce upfront capital expenditure and reduce lead time to production by a minimum of 18 months.

BACKGROUND GEOLOGY

The project covers ground in the Matchless Copper Belt, located within the Damara Orogenic Belt in central Namibia. The Matchless Copper Belt is known for its volcanogenic massive sulphide (VMS) deposits, which are typically hosted in metamorphosed volcanic and sedimentary rocks. The area is dominated by massive mica schists of the Kuiseb Formation of the Pan-African Damara Orogen, and overlain by superficial quaternary sand and gravel. Geophysical data suggests that the prospective Matchless Copper Belt may extend over a potential 128km strike length across the three licences.

The region has undergone significant deformation during the Damara Orogeny, resulting in the folding, faulting, and metamorphism of the host rocks. The Hope Deposit is located on the northern limb of the Hope Synform, which forms a portion of the southwestern section of the Matchless Copper Belt. The copper and gold mineralisation occurs within pyrite lenses which are mainly found in magnetite-quartzite or magnetite-bearing quartzitic schists.

Figure 2: Vendome hole VED001 42m – semi-massive chalcopyrite mineralisation

Figure 3: Pyrite mineralisation within drillcore

2023 UPDATED MINERAL RESOURCE ESTIMATE

On 27 October 2023 Bezant announced an updated Mineral Resource Estimate for the project. The MRE was completed by Addison Mining Services Ltd., an independent consultancy based in the United Kingdom and reported in Indicated and Inferred categories in accordance with the JORC Code (2012).

The updated total MRE estimated across the Hope, Gorob, Vendome and Anomaly deposits includes a total of 15 million tonnes gross at 1.2 % Cu for 190 thousand tonnes of contained copper, including;

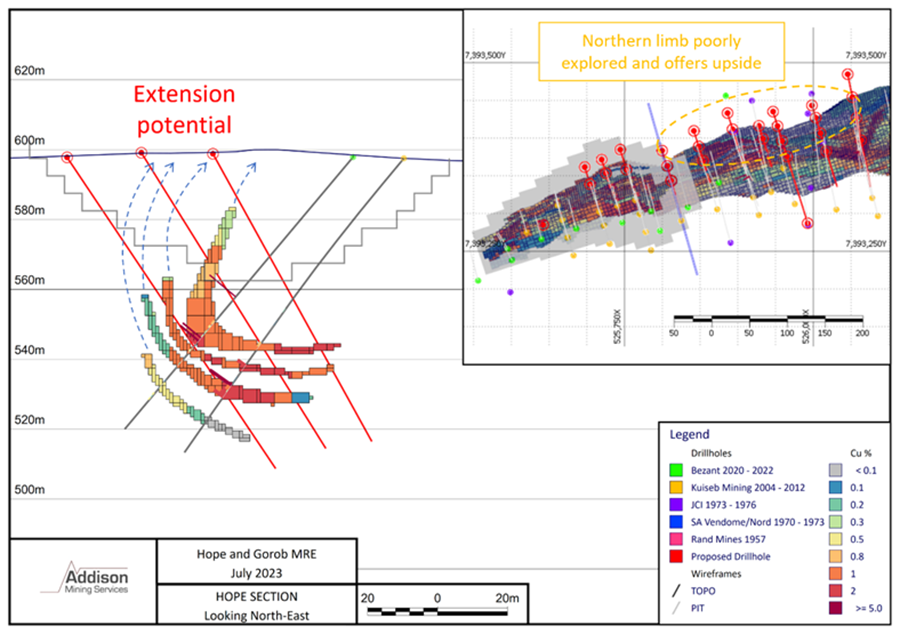

Significant exploration and resource upgrade potential remains, including extensions to the existing open pit resources which are considered to be extremely likely and are only omitted due to a historic low drill density that precludes conversion to a JORC Resource.

Table 1: Indicated and Inferred Mineral Resource Estimate for the Hope and Gorob Project, Namibia. *Gross representing 100% estimated Resources – Bezant has a 70% interest in the Hope and Gorob Project (**Reference notes appended at bottom of page)

| Area | Cut-off | Type | Tonnes | Den-sity | CuEq% | Cu% | Au g/t | Ag g/t | Cu t | Au ozt | Ag ozt |

| INDICATED | |||||||||||

| HOPE | 0.25 | Open Pit | 290,000 | 3.0 | 1.6 | 1.4 | 0.30 | 4.7 | 4,100 | 2,800 | 44,000 |

| 0.70 | Underground | 950,000 | 3.0 | 1.9 | 1.7 | 0.40 | 6.7 | 17,000 | 12,000 | 210,000 | |

| Subtotal Indicated | 1,240,000 | 3.0 | 1.8 | 1.6 | 0.4 | 6.2 | 21,100 | 14,800 | 254,000 | ||

| INFERRED | |||||||||||

| 0.25 | Open Pit | 140,000 | 3.0 | 1.2 | 1.1 | 0.30 | 3.1 | 1,500 | 1,400 | 14,000 | |

| 0.70 | Underground | 2,800,000 | 3.0 | 2.0 | 1.7 | 0.43 | 6.1 | 49,000 | 39,000 | 550,000 | |

| Subtotal Inferred | 2,940,000 | 3.0 | 2.0 | 1.7 | 0.4 | 6.0 | 50,500 | 40,400 | 564,000 | ||

| INDICATED PLUS INFERRED | |||||||||||

| Subtotal Open Pit | 430,000 | 3.0 | 1.5 | 1.3 | 0.3 | 4.2 | 5,600 | 4,200 | 58,000 | ||

| Subtotal Underground | 3,750,000 | 3.0 | 2.0 | 1.7 | 0.4 | 6.3 | 66,000 | 51,000 | 760,000 | ||

| Subtotal Hope | 4,200,000 | 3.0 | 1.9 | 1.7 | 0.4 | 6.0 | 71,000 | 55,000 | 810,000 | ||

| INFERRED | |||||||||||

| GOROB | 0.25 | Open Pit | 800,000 | 3.0 | – | 1.1 | 0.1 | – | 8,700 | 2,000 | – |

| 0.70 | Underground | 5,100,000 | 3.0 | – | 1.2 | 0.1 | – | 58,700 | 18,000 | – | |

| Subtotal Gorob | 5,900,000 | 3.0 | – | 1.2 | 0.1 | – | 67,400 | 20,000 | – | ||

| VENDOME | 0.25 | Open Pit | 310,000 | 3.0 | – | 1.6 | – | – | 5,000 | – | – |

| 0.70 | Underground | 3,300,000 | 3.0 | – | 1.0 | – | – | 35,000 | – | – | |

| Subtotal Vendome | 3,610,000 | 3.0 | – | 1.0 | – | – | 40,000 | – | – | ||

| ANOMALY | 0.25 | Open Pit | 850,000 | 3.0 | – | 0.6 | – | – | 5,300 | – | – |

| 0.70 | Underground | 680,000 | 3.0 | – | 0.9 | – | – | 6,000 | – | – | |

| Subtotal Anomaly | 1,530,000 | 3.0 | – | 0.7 | – | – | 11,300 | – | – | ||

| TOTAL | 0.25 | Open Pit | 2,400,000 | 3.0 | – | 1.0 | – | – | 24,600 | 6,200 | 58,000 |

| 0.70 | Underground | 12,800,000 | 3.0 | – | 1.3 | – | – | 165,700 | 69,000 | 760,000 | |

| Grand Total | 15,200,000 | 3.0 | – | 1.2 | – | – | 190,300 | 75,200 | 818,000 | ||

| Total Indicated | 1,200,000 | 3.0 | 1.8 | 1.6 | 0.4 | 6.2 | 21,100 | 14,800 | 254,000 | ||

| Total Inferred | 14,000,000 | 3.0 | – | 1.2 | – | – | 169,200 | 60,400 | 564,000 | ||

GOLD POTENTIAL AT HOPE AND GOROB

The 2023 MRE ignored gold content for all prospects other than the Hope target on the basis that many historic boreholes (pre-dating Bezant’s involvement) were not assayed for gold, and as such gold could not be included in the resource compilation. Historical grab sampling, and resource upgrade drilling completed by Bezant in 2022 indicate the potential for the occurrence of copper-gold mineralisation at several prospects, and Bezant intends a programme of drillhole twinning to enable the inclusion of gold results in the MRE.

Copper concentrate containing gold has been well received by the refining industry with gold credits attracting good payability. At a gold price of US$2,700 per ounce, and an envisaged typical gold credit of up to 0.4g/t Au based on the Hope mineral resource, there is a potential gross contribution of up to US$35 per tonne of ore at this grade.

Bezant is testing a hypothesis that gold and copper are not evenly distributed throughout the resource, suggesting high-gold and associated copper grades are related to structural control. Drilling completed by Bezant included peak gold grades of 2.0g/t Au over 1.35m in HPD004 at Hope, and 5.89g/t Au over 1.76m in VED001 at Vendome, and historical drilling returned a peak gold intercept of 1.01m at 22g/t Au with 3.98% associated copper in drillhole HDD0035. It is hoped that remodelling structural control at the deposit may direct resource modelling towards areas with greater gold & copper potential.

Figure 4: Mapping copper mineralisation at Gorob

BEZANT EXPLORATION HOPE & GOROB

In 2022, Bezant completed 21 angled diamond core drill holes, totalling 1,371.5m of drilling, with the intention of extending known resources to shallower depths. Drilling was carried out at Hope, Gorob, Vendome, Anomaly, and Du Preez prospects. The results confirmed mineralisation extending towards the surface within depths suitable for open-pit mining, with significant shallow resource extensions identified at Hope, Gorob, and Vendome.

At Gorob, drill intercepts revealed near-surface mineralisation extending over a strike length of more than 500 meters, with peak downhole intercepts reported at 2.16% Cu and 0.35g/t Au over 2.4m in hole GRD006. Vendome returned high-grade, near-surface intercepts, including a return of 3.81m at 4.6% Cu and 2.80g/t Au from 39.32m depth in hole VED001. Wide intersections were returned across notable strike width at Hope, with best intercepts including a return of 14.28m at 2.4% Cu and 0.36 g/t Au from 25.2m depth in hole HPD003, and 16.97m at 1.49% Cu and 0.23 g/t Au from 15.5m depth in hole HPD004.

The results of this drilling have now been incorporated into the 2023 MRE and subsequent mine development planning.

Figure 5: Drilling at the Hope resource

Figure 6: Gorob shallow drilling hole GRD003 – green malachite copper mineralisation

FURTHER EXPLORATION POTENTIAL

There is considerable opportunity to increase the 2023 MRE tonnage at the Hope, Gorob, Vendome and Anomaly deposits. A conceptual resource upgrade model, which considers extensions of resources along-strike and down-dip at reasonable thicknesses, suggests that an additional 1.2Mt of ore could be defined at an average grade of 1.1% Cu. This would result in an extra 14,000 tonnes of copper being added to the operation. Table 2 provides a summary of the open-pit exploration potential across all resources. It is important to note that these figures are conceptual in nature and may not be realised.

At the Hope deposit, drilling and sampling in the upper overturned limb of the plunging fold have not sufficiently tested the mineralisation. As a result, there is potential to expand the open-pit resource in this area, incorporating additional near-surface mineralisation to the resource, in an area benefiting from favourable stripping ratios.

Table 2: Summary of exploration potential across all prospects

| Area | Extension (m) | Thickness (m) | Down Dip Depth (m) | Volume (m3) | Density (t/m3) | Tonnage (t) +/- 25% |

Cu (%) +/- 25% | Cu (t) +/- 25% |

Au g/t |

| Anomaly NE | 200 | 3 | 50 | 30,000 | 3 | 90,000 | 0.6 | 540 | 0.2-0.4 |

| Anomaly SW | 200 | 9 | 50 | 90,000 | 3 | 270,000 | 0.6 | 1,620 | 0.2-0.4 |

| Gorob NE | 200 | 4 | 80 | 64,000 | 3 | 192,000 | 1.2 | 2,304 | 0.2-0.4 |

| Vendome NE | 200 | 2.5 | 60 | 30,000 | 3 | 90,000 | 1.4 | 1,260 | 0.2-0.4 |

| Vendome SW | 200 | 6 | 40 | 48,000 | 3 | 144,000 | 1.4 | 2,016 | 0.2-0.4 |

| Hope | 165,000 | 3 | 500,000 | 1.3 | 6,500 | 0.3-0.6 | |||

| Grand Total | 1,286,000 | 1.11 | 14,240 |

Figure 7: Exploration potential at Hope

Further potential exists elsewhere in the greater project area, the Niedersachsen deposit cluster includes three previously discovered copper prospects (Niedersachsen, Aros and Kobos) within EPL 6605, and one copper prospect situated in EPL7170 (Schlesien, situated close to the north-eastern border of EPL 6605). While the primary historic exploration focus has been on the known prospects this has left the large majority of the 800km2 area unexplored, especially by modern exploration techniques.

HOPE COPPER-GOLD TRANSACTION INFORMATION

PROJECT ACQUISITION

Bezant acquired 100% of Virgo Resources Ltd, incorporated in Australia (ACN 626 148 347) (“Virgo”) (the “Acquisition”) on 14 August 2020. Virgo through its 100% owned Australian subsidiary Hepburn Resources Pty Ltd (ACN 624 189 162) owns i) 70% of Hope and Gorab Mining Pty Ltd incorporated in Namibia which owns EPL5796, ii) 80% of Hope Namibia Mineral Exploration Pty Ltd Incorporated in Namibia which owns EPL6605 and EPL7170. The balance of the project is held by local Namibian partners.

The share and cash consideration payable by Bezant at completion of the Acquisition was i) the issue of 422,062,525 new ordinary shares of 0.002 pence each in the capital of the Company (“Bezant Shares”) at a deemed issue price of 0.2 pence per Bezant Share (“Ordinary Shares Consideration”), ii) £135,000 settled by the issue of 113,333,333 new Bezant Shares of which 79,333,333 have been issued and 34,000,000 are to be issued on 15 February 2020 (the “Asset Sellers Consideration”); and iii) cash of AUD157,021 (approx.. £86,600 (the “Consideration”).

EPL5796 is held by Hope and Gorob Mining (Pty) Ltd which is 70% owned by Hepburn Resources Pty Ltd (100% owned subsidiary of Virgo) and 30% owned by a local partner. EPL6605 and EPL 7170 are held by Hope Namibia Mineral Exploration (Pty) Ltd, which is owned 80% by Hepburn Resources Pty Ltd and 20% by a local partner.

Option Consideration: Bezant issued 98,361,250 unlisted Options which vested on 1 August 2021 and expired on 31 August 2023 with an exercise of 0.30 pence which represented a premium of 150 per cent. to 0.12 pence being the closing middle market price on 18 June 2020 when Bezant entered into an agreement to acquire Virgo and through it the Hope Copper Gold project.

Deferred Consideration: The deferred consideration of £400,000 potentially due to the vendors of Virgo is not due as there was not within 36 months of completion of the Virgo transaction a total Mineral Resource (as defined in the JORC code (2012 addition)) (Mineral Resources) on any of the current or future projects of Virgo of 400,000 tonnes of contained copper.

**Notes relating to Mineral Resource Estimate:

- The independent Competent Person for the Mineral Resource Estimate, as defined by the JORC Code (2012 edition), is Mr. Richard Siddle, MSc, MAIG, of Addison Mining Services Ltd since November 2014. The effective date of the Mineral Resource Estimate is 30th of May 2023 and was signed on the 29th of August 2023. Mr Siddle completed a site visit between 27th April and 28th April 2023.

- No mineral reserve estimates have been undertaken. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The quantity and grade of reported Inferred Resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured, however it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration and verification including infill drilling, further verification of legacy drillholes via twin drilling and metallurgical testing. Following further exploration it may be possible to convert some of the Inferred Mineral Resources to Indicated Mineral Resources.

- Copper Equivalent is based on assumed prices of US$9,000 per tonne Cu, US$1,800 per oz Au and US$20 per oz Ag. Recovery and selling factors (see below) were incorporated into the calculation of Cu Eq values. It is the Company’s and Competent Persons’ opinion that all the elements included in the metal equivalents calculation (copper, gold and silver) have a reasonable potential to be recovered and sold.

- Cu Eq% is calculated as Cu% + (Au×0.512)

- Cut off grades assume a Cu price of $9000 per tonne and Au price of $1800 per troy ounce at 85% and 90% payability respectively, a treatment charge of $183.35/t of Cu metal is also applied. Process recovery is assumed as 88% for Cu and 65% for Au. Operating costs are assumed as $14/t for processing and $1.5/t for G&A, $30 for underground mining and $2.5 to 3 for open pit mining. An additional allowance of $0.5 is made for ROM transport assuming a shared processing facility.

- Indicated and Inferred mineral resource categories set out in the table above at cut-off grades >0.25% CuEq/Cu for open pit and 0.7% CuEq/Cu for underground mining comply with the resource definitions as described in the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. The JORC Code, 2012 Edition. Prepared by: The Joint Ore Reserves Committee of The Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia (JORC).

- Numbers are rounded to reflect the fact that an Estimate of Resources is being reported. Rounding of numbers may result in differences in calculated totals and averages. All tonnes are metric tonnes.

- Pit slopes were assumed as 45 degrees in overburden and fresh rock. No geotechnical studies have been completed to support this assumption and the requirement for shallower pit slopes may serve to materially reduce the open pit mineral resource.

- The absence of metallurgical results from direct test work currently underway in relation to Hope & Gorob are not incorporated in the report due to delays in receiving them from the laboratory. Their non-inclusion is not considered material for the purpose of reporting updated resources in accordance with JORC (2012).

- The Mineral Resource Estimate set out above are quoted gross with respect to the Project. Bezant Resources has 70% interest in the Project and accordingly the Net attributable to the Company is 70% of the quoted gross.