- Home

- Homepage Information Panel

Homepage Information Panel

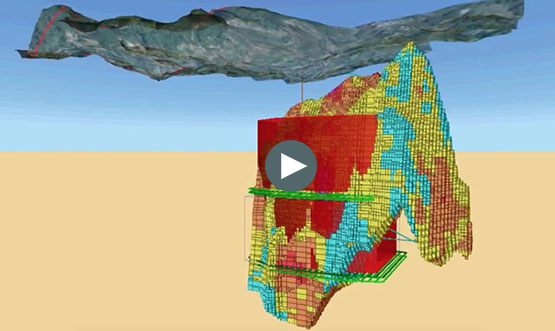

- 2019 Economic Study (Mining Plus)

- Alternative routes to production: The Mankayan copper-gold porphyry supports different robust routes for potential future development, including, for the first time, a Sub-Level Caving ("SLC") 'stepping stone' scenario, with two main Block Caving ("BC") routes identified for progression, from a total of 11 scenarios assessed, with both supporting an average production grade in excess of 0.64% copper equivalent ("CuEq").

- 5 year lead time to production: Under all four of the representative options selected for further analysis in the study, the time to initial production was approximately five years and the first five years of production was sequenced in order to deliver production from the higher grade areas of the deposit, in some cases demonstrating average grades achievable of up to 0.77% CuEq* during this initial period.

The three main representative options summarised below, taken from the 11 modelled scenarios, comprise two BC scenarios and one SLC 'stepping stone' scenario (the option numbers being those used in the study)

The two preferred BC scenarios

- Option 4: medium production rate with lower start-up costs than those associated with higher production rate models

- US$1,181m net present value ("NPV")*, US$11,647m total revenue, US$19.1/t average cost, 27% internal rate of return before tax and royalty ("IRR"), US$896m start-up Capex

- Option 8: lower start-up costs, coupled with a good overall project value maintained by ramping-up the production rate after the first footprint

- US$797m NPV*, US$11,473m total revenue, US$19.7/t average cost, 21% IRR, US$633m start-up Capex

SLC intermediary route

- Option 9: a more flexible/low start-up cost SLC method has been determined as an intermediary step towards full block caving scenarios, with start-up Capex of US$529m, a slightly reduced time to first production, a first phase period into higher grade core and US$19.9/t average cost

- Independent Resources Estimation (2009 - Snowden Group):

- Indicated JORC Resource of 1.1 million tonnes of copper and 3.7 million ounces of gold

- Inferred JORC Resource of 0.2 million tonnes of copper and 0.6 million ounces of gold

Note: * - The NPV calculated is for comparative purposes only, as full financial analysis was not undertaken for the study. A mean copper price scenario of US$3/lb was used and all costs are mine and processing combined. Due to the current uncertainty surrounding the Philippine tax/royalty rates, neither have been included in the comparison. Inclusion of tax and royalty would reduce the NPV and IRR, but it is expected that the relative economic merits of each scenario would not change significantly.

- Flagship project located in Province of Leon, Spain -Exploration license renewed Q4 2017 for three years

- European support infrastructure; Located near road, power, rail in traditional mining area- direct road access to existing Smelters

- Over 44,000 meters previously drilled on project- data package being reprocessed by Europa leading to;

Maiden JORC (2012) resource announced January 2018:

- 16 million tonnes at 6.9%Zn Equivalent (including Pb credits) and 25 g/t Ag total Inferred Resource Estimate (approx.)

- Individual zinc and lead grades are 4.0% Zn, 3.3% Pb, with an estimated metal content of 670,000 tonnes of zinc, 540,000 tonnes of lead and 13 million troy ounces of silver.

- 2018 Outlook: a. PEA b. extension drilling along strike c. metallurgical testing